The Budget Software Project

Phase 3 – Mint.com Review

OBJECTIVE: To research, test, and review the popular online financial assistance website Mint, which will help new budgeteers with choosing suitable personal finance software.

REVIEW CRITERIA: To make this review as comprehensive as possible while still maintaining an air of brevity and creativity, I will divide it into 4 categories as follows:

1. Program History: A brief overview of the program, how it was created, and why it is currently in use today.

2. A User Instructions: A step by step overview of each feature on Mint.com.

3. Observations: My journey through Mint. This includes my experience with the various features along with the strengths/weaknesses of the website.

4. Conclusion: Why or why it is not the budget software of choice.

-PROGRAM HISTORY-

Mint.com originated from the mind of one accountant Aaron Patzer in 2005, because he was tired of the tedium of offline financial management work (categorizing hundreds of purchases by hand, then combing through never ending bank statements). Using his Master Degrees from Princeton and Duke, he came up with two breakthrough technologies which made Mint stand out:

A. The categorization tool which sorts bank, credit, loan, investment, and retirement

accounts into individual sections which can be tracked, managed, or combined to provide

realistic goals.

B. A search engine that pairs the user with different forms of saving options or financial

assistance companies.

After two years of continuous development, the beta version of Mint.com was finally released to the public. One year of operations later, the online financial software had over half a million users which led to it being called one of the top 50 websites of all time by Time magazine.

After acquiring numerous honors and awards, Aaron Patzer sold the web giant to Intuit (the founders of Quicken and Turbo Tax), but he still continued to be involved as Vice President and General Manager of all Intuit’s personal finance groups. Due to this acquisition, Mint.com gained more than a million users, and continues to be one of the leading online free personal finance websites to this day.

-A USER INSTRUCTIONS-

The layout of the ledger system on Mint is categorized into roughly 10 sections, each of which is briefly summarized during the tutorial like tour of the site (Both the Alerts and the Budget ledgers include video tutorials).

Alerts

Once your budget is set up, you will be alerted for one of two things: any changes in your

spending (you will be suggested to spend less money and find ways to save). You will also be

alerted to any big upcoming payments (credit cards, rent, loans, etc). Since this is the very first

ledger one sees when logging in to Mint it is an effective reminder.

Advice

Each time you log on, you will be given different advice based on previous spending patterns. I

have been advised to take up new credit cards, begin retirement accounts, and obtain discounts

for insurance, amongst other things. You can adjust the settings of this ledger by putting in more

personal information (I kept seeing different forms of advertisements for car insurance, most

likely because I set up a goal of saving up for a new car in the goals ledger).

Reminders/ Bills

Essentially this serves a similar function as the alerts ledger, except it displays the next 30 days

on a line graph, and an additional list of upcoming bills beneath it. Upcoming payment days are

marked on the graph, and more information is displayed when you click on it.

Budget

The budget ledger on the home page is only meant to glance at when in a hurry. To set up the

budget you need to head over to the budget tab. On this page there are a couple sections to

explore:

1. The income ledger allows one to input how much money they make each month, and the bar

graph will indicate how much of that expected income you have obtained so far.

2. The spending ledger shows all of the categories for your budget represented by

individual bar graphs. The first time you log on (after your bank information has

been uploaded) your transactions for the current month are automatically delegated

into certain categories (Ex: I spent $30 at Ralphs, that amount was included in the

Groceries category). You can adjust names of categories and the amount you

would like to plan on spending for the rest of the month.

3. The uncategorized ledger is for transactions which Mint does not know how to

categorize. It is easy to add them to pre-existing categories or create new ones.

4. The goals ledger is also shown under the budget.

5. The You’ve budgeted… ledger at the top of the page shows Income, Overall

Spending, How much you want to save for a goal, and how much you currently

have left over; to sum it up.

Transactions

While the transactions page isn’t included in the initial overview of all your ledgers, it is very

easy to locate. Since all of your transactions are already uploaded to the site, this page is used for

categorizing individual transactions that don’t fit in to the pre-given categories in the budget.

Add any cash transactions to really get the most out of managing your finances.

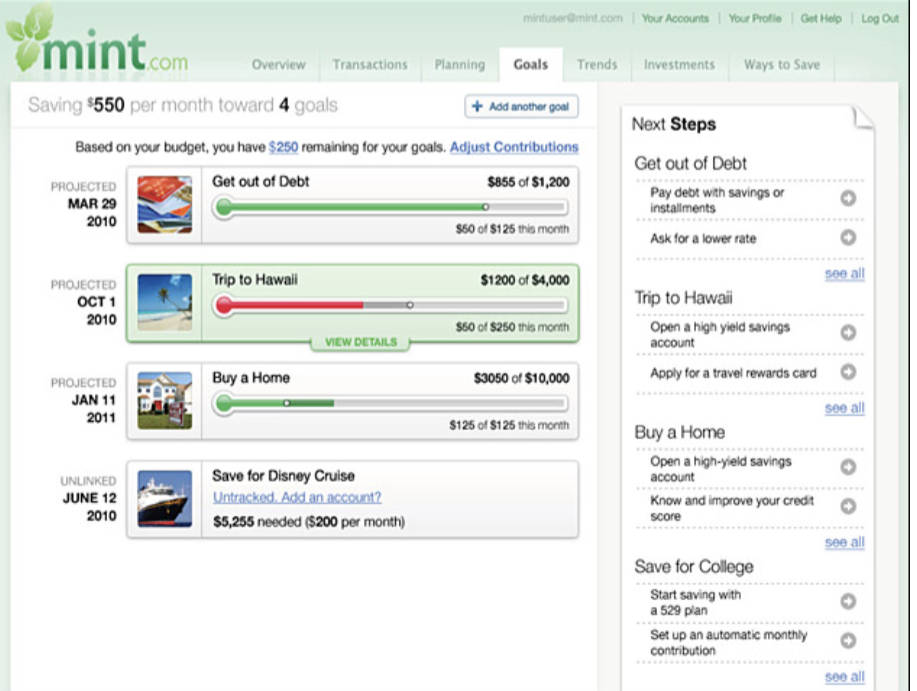

Goals

Set up individual goals to save up for, whether that is saving for a car, buying a home, or opening

a high-yield savings account. Each goal is connected to one of your accounts, so you can select a

set amount to save each month (It even lets you upload a picture for each goal to personalize it).

Once the goal is set up you can check in on the bar graph to see how close you are to reaching

that goal.

Investments

Upload different investment accounts to keep track of. You can also upload brokerage accounts.

If you have no investments it will suggest 4-5 different highly recommended investment sites.

Ways to Save

Suggested savings opportunities based on prior spending habits. These range from credit cards,

savings plans, home/car loans, credit scores, tax assistance, loan counseling, new accounts, etc.

Trends

There are various charts and graphs to compare recent spending history to past and future

history. Compare how your spending match up to others. There are also options to compare

assets, net worth, debts, and income.

Accounts

A general overview of all accounts including but not limited to bank, credit, loans, investments,

and any other assets you would like to keep track of.

-OBSERVATIONS-

Having read a lot of positive reviews about Mint in addition to knowing of the vast user base it holds, I was excited to begin a new budgeting experience. Keeping in mind that Mint boasts a customizable ledger system to stack finances, and strategies for net worth/ investing, I decided to check out the website first. However, I was unable to view anything until I created an account. So I did just that, and began to set up an account process by inputting banking information, goals/plans, and personal information.

***During the account set up process I had to input

bank/credit information to successfully complete the

process. This is a requirement that cannot be bypassed;

otherwise, Mint is not for you. There has been some

concern by users, but Mint does store all information in

a safe decryptable format similar to other well known

Intuit programs. Not only that, but one is logged out if

inactive for more than 5 minutes. So I proceeded with a

degree of caution ***

I was immediately taken on a tour of each section from

the Alerts feature all the way to the trends feature. The

sections were generally hit/miss. Some of them felt very

beneficial to budgeting while others felt more supportive

of financial assistance. I was disappointed that a few of

the features felt irrelevant. For example the Alerts and the Upcoming Bills sections served the exact same purpose, while the Advice and the Ways to Save section also felt like they were trying to serve the same purpose. As such it made the various sections feel cluttered.

It was extremely convenient having all of my account information already uploaded to the system. I was able to create a budget based off my spending pattern from the previous month. Then I could view different trends based off my spending, and formulate a strategy to adjust my spending differently for next month. All of my debt including loans and credit cards were displayed very accurately, so I am automatically reminded of payment dates from the moment that I log on.

I was fond of the goals sections where I could create a goal (ex: save up for a car), and budget how many months of saving I would need to reach that goal. I didn’t like that each goal can only be connected to one account at a time, but it did help to get in to the mind set of only focusing on one goal.

I was very disappointed by the savings/advice sections, because it felt more like a bunch of advertisements for affiliate companies than beneficial advice from Mint. This feels like a downside of Mint having been bought out by a larger company. If I am in the mindset of trying to fix my finances, the last thing I need is to be advertised at to spend more money.

The website is formatted very basically so I did not have trouble finding any features, but there were times where it took some messing around to figure out how to accomplish smaller tasks such as comparing loans.

*Lastly I had heard that there was an education aspect to Mint so I had to do some research to locate where it was. It turns out that there is a separate website (of which none of the links are located on Mint.com) called Mint Education. The site is devoted to educating youth about financial freedom. I came upon a lot of lesson plans, a finance game, and not much else. Mint Education honestly felt like they were targeting an audience that is just too young to understand financial freedom, let alone budgeting.*

-CONCLUSION-

Mint has its strengths and weaknesses while appealing to a larger

demographic, because of the inclusion of more financial assistance

features (Investments and loans to name a few).

For pure budgeting purposes it was very nicely put together. I was rather

fond of the layout of the budget ledger, because it felt very clean, very

easy to adjust, and easy to personalize. Since your information is already

uploaded to the system it feels like a breeze to manage. Not only that,

but the color coding was also nicely done. Even the goals feature which

felt like an addition to the budget feature was nicely executed.

The downside for me was that I could only budget for the current month,

and if you are like myself and prefer to budget bi-weekly, then it makes

the process more challenging to manage.

Budgeting feature aside, the rest of the website turned me off to it. It felt

like they tried to add more features to fill up space. The advertising

was annoying. There was nothing special about any of the other features.

Granted I do not have multiple investments so this feature was useless

for me personally. For a user with multiple investments, multiple loans,

bills that multiply by the family member, and other things to worry

about this might be the perfect website for them.

For a new individual who is starting out with budgeting… not so much.

On a scale of 1-5 (1 being the worst and 5 the best) I give it:

Overall Rating: 3.0

Next time I will review the simplest of the three popular budgeting programs… Mvelopes.

Until next time.